GGL is a Canadian-based junior exploration company focused on the exploration and advancement of under evaluated mineral assets in politically stable, mining friendly jurisdictions.

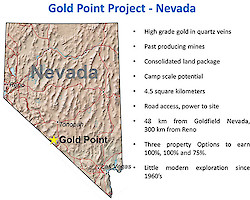

The Company has optioned and wholly owned claims in the Gold Point district of the prolific Walker Lane Trend, Nevada. The Gold Point claims cover several gold-silver veins, four of which host past producing high-grade mines. The mines operated intermittently from the 1880s to the early 1960s, producing gold and silver from mesothermal veins. The mineralization is strongly oxidized to the bottom of the workings, which reached a maximum depth of 1,020 ft (311 m) downdip.

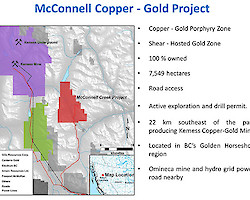

The Company also owns the McConnell gold-copper project located 22 kilometers southeast of the Kemess Mine in north-central BC, and promising diamond exploration projects in Nunavut and the Lac de Gras diamond district of the Northwest Territories. Lac de Gras is home to Canada’s first two diamond mines, the world class Diavik and Ekati mines discovered in the 1990s. .;

GGL also holds diamond royalties on mineral leases near the Gahcho Kué diamond mine in the Northwest Territories

The Company has a diverse and seasoned Board combined with experienced Management which together have a track record of success. Industry recognized Advisors compliment this team with decades of gold, base-metal and diamond exploration and development experience.

Latest News

- April 10, 2024 GGL Identifies a 1.8 km by 1 km Induced Polarization Anomaly at the Le Champ Copper-Molybdenum-Gold Porphyry Target, Gold Point Project, Nevada

- March 27, 2024 GGL Resources Corp. Closes Initial Tranche of Private Placement

- March 20, 2024 GGL Doubles the Length of Precious Metals Rich Vein Systems at its Gold Point Project, Nevada